Bain Study Says 40% of Pharma Companies Factoring in Generative AI Savings in 2024

Productivity is the goal and budget cuts the logical result

A new phenomenon emerged during the 2023 enterprise budgeting season this past fall. In industry after industry, financial managers began asking business leaders to prospectively factor in budget savings from AI initiatives. While these benefits were sought across AI-based use cases, generative AI was a significant focus. Some of those savings were expected to manifest in 2024. Other companies are assuming 2025 or 2026.

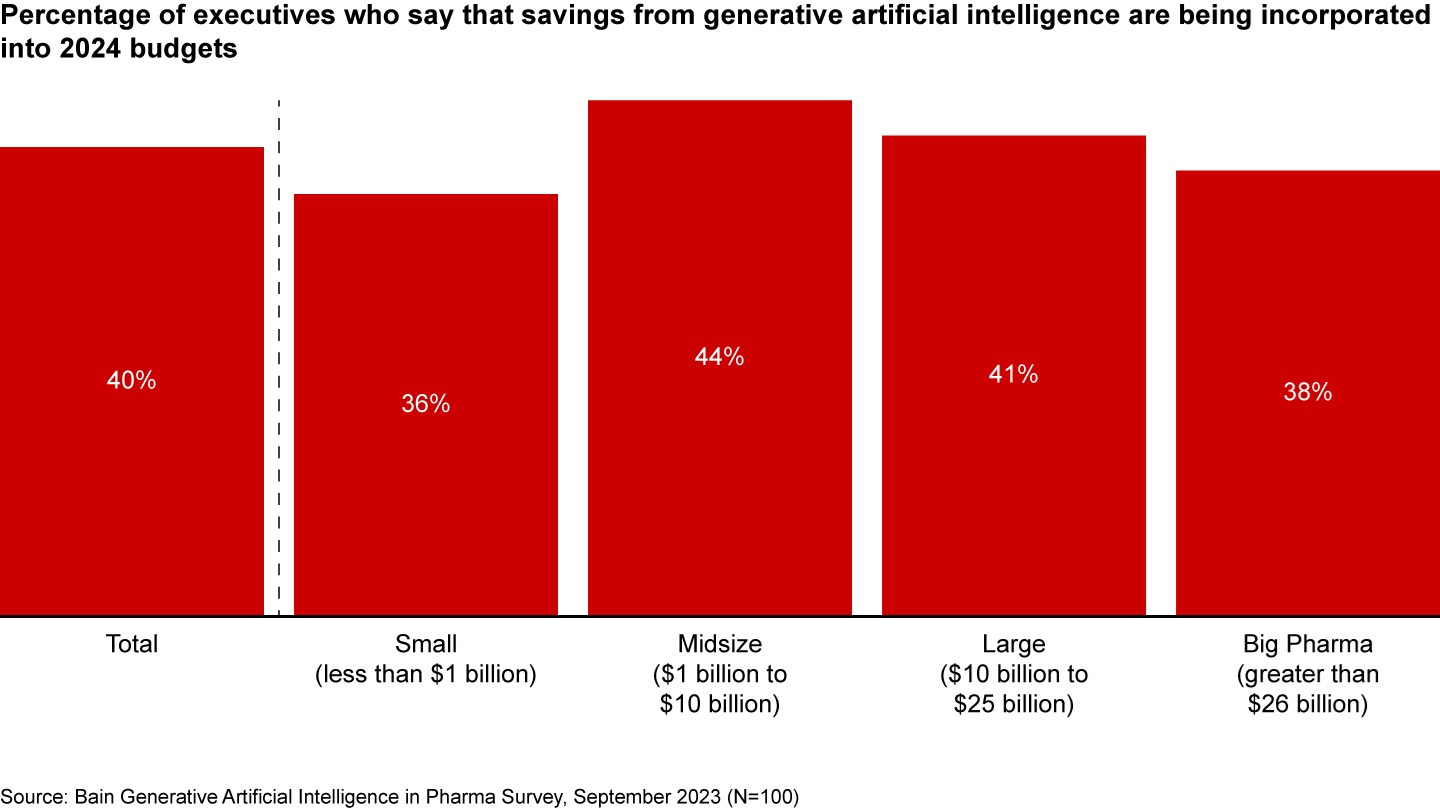

Bain recently published the results of a September 2023 study of 100 pharmaceutical industry executives. It found that 40% of pharma executives expected to reduce their 2024 budgets due to planned savings driven by generative AI capabilities. The result was lowest for pharma companies with less than $1 billion in revenue (36%) and highest for the revenue range of $1 billion to $10 billion (44%).

Granted, there is no information related to how large the savings are expected to be. In some cases, the savings may be sparingly small. However, some functional divisions in a variety of industries are targeting double-digit savings. Pharma executives told Bain they were moving to production solutions last fall for multiple solutions.

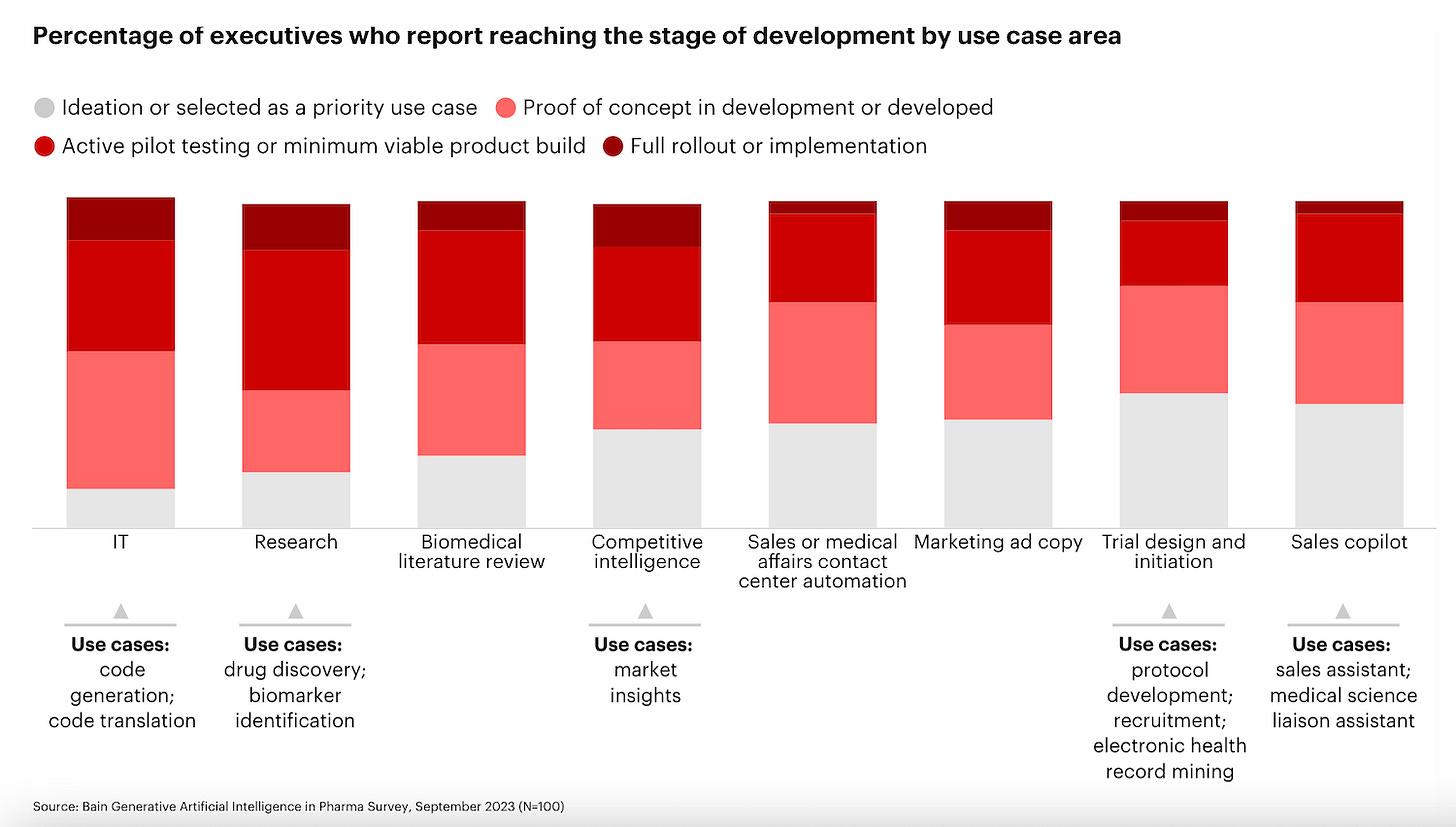

Nearly 60% of executives say that they have moved beyond ideation and brainstorming to building out use cases. In fact, 55% reported that they expected to have multiple proof-of-concept or minimum viable product builds by the end of 2023.

IT and Research Lead the Gen AI Way

The Bain study indicated that IT and research use cases were furthest along the generative AI adoption path. Nearly all of the companies indicated that generative AI was being used in some form for use cases across code generation and translation. Biomedical literature review and competitive intelligence were also popular, at least for the proof of concept development stage.

According to the Bain researchers:

Classical data science and machine learning are nothing new to pharma executives who have been investing in productivity enhancements for years, primarily in the drug discovery space. Bain research shows that 54% of pharma companies have automated biomedical literature review solutions, and 46% are using AI as part of their process to find potential disease targets.

Now, generative AI is broadening the aperture of use cases with new opportunities across the value chain. Biomedical literature review and preclinical research remain among the most popular use case areas, although we’re also seeing high investment in IT and competitive intelligence. Within these top areas, more than 60% of executives, on average, say that they have at least a proof of concept in development, and around 10% have already rolled out tools.

The data highlights how broadly generative AI is expected to impact pharmaceutical companies. Generative AI is not just for code and content generation or summarization. Procurement, finance, and supply chain management are also targets for productivity gains. The study shows results for 15 functional activities in pharma companies. Only finance and compliance are listed as having less than half of companies at least working on a proof of concept.

A recent Synthia analysis of 18 banks found that one-third had announced they are using generative AI for risk management, and a similar amount are using it for fraud detection. Over 20% are using it for compliance. The rate exceeds 70% for customer experience use cases. So, all use cases have not captured the same level of popularity. That is expected. On the other hand, many people were not expecting such broad-based applicability.

Returning to first principles, consider the breakthroughs ushered in by large language models (LLM). They are enabling organizations to automate tasks related to text data. Unstructured data has resisted automation and relied on human intervention, which is certainly slow and very often inconsistently applied. So, the biggest immediate impact will be in functional areas that predominantly deal with generating, recording, or interpreting text, which are often words and sometimes code.

This is also true when you abstract the analysis to industries. Pharmaceutical companies definitely traffic in a lot of numbers. However, they also rely heavily on words. Using generative AI to extract benefits from large quantities of unstructured text-based data is exactly what we should predict from the pharma industry.

Productivity is the Driver

Synthedia suggested in 2022 that hyper-creation and hyper-personalization benefits will be enabled by generative AI. However, hyper-automation will drive initial adoption, with productivity as the key motivation.

Productivity can manifest in higher throughput and better service without reducing budgets, but very often, the direct result is lower operating costs. That is why pharma industry executives are already living with lower 2024 budgets. The question now is whether generative AI capabilities will actually meet the forecasted savings expectations.

Microsoft Azure AI Users Base Rose by 50%, Half of Fortune 500 Adopt OpenAI Service

Microsoft’s Q2 2024 earnings announcement highlights the positive impact generative AI is having on the business. Overall, Microsoft’s revenue climbed 18% over Q2 2023. A meaningful portion of that growth was driven by a 30% rise in Azure cloud revenue, where generative AI is a key driver.