Generative AI to Reach $1.3 Trillion in Annual Revenue - Let's Break That Down

New data from Bloomberg Intelligence

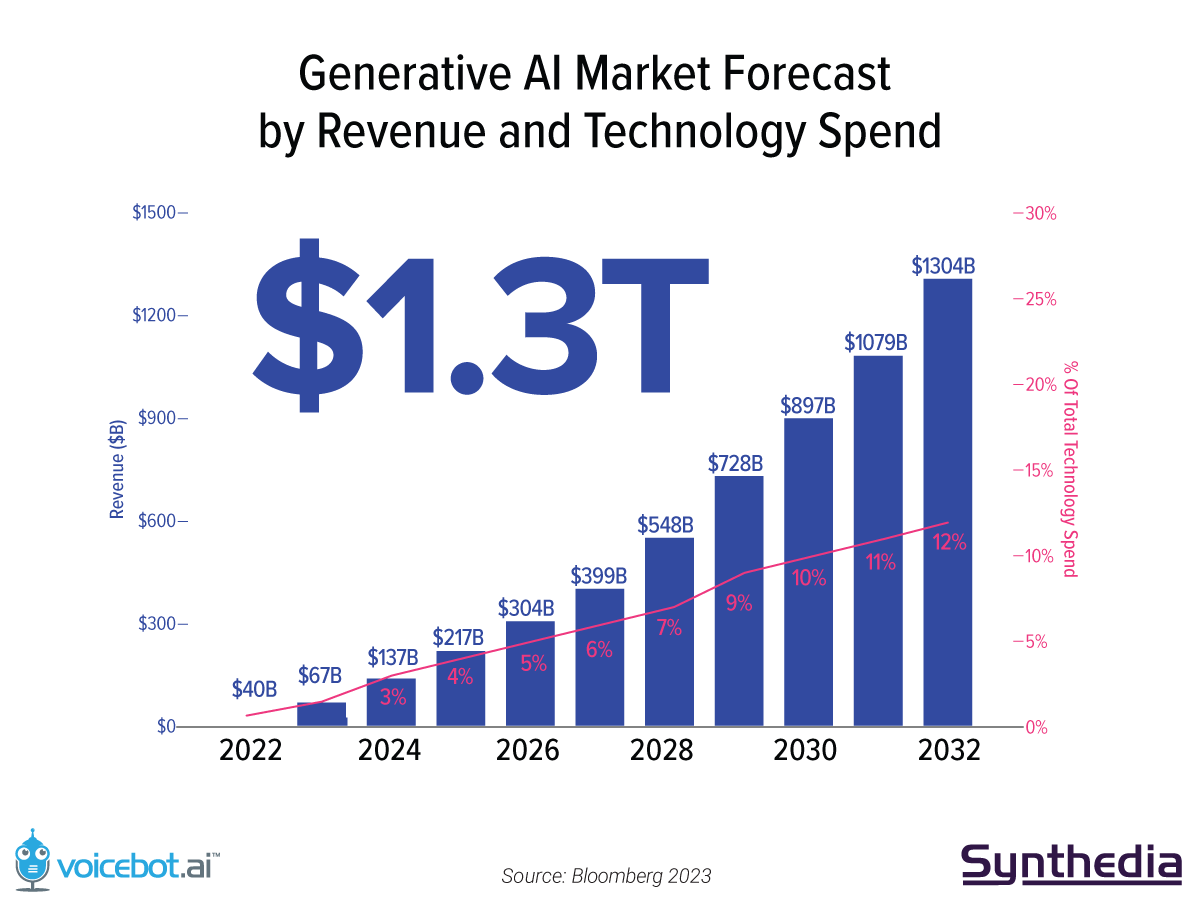

Bloomberg Intelligence forecasts rapid growth for generative AI, rising from about $40 billion in 2022 to $1.3 trillion in 2032. During that period, generative AI will climb from less than 1% of total IT spending to 12%. The growth forecast predicts a 42% compound annual growth rate (CAGR). According to the report:

Mandeep Singh, Senior Technology Analyst at Bloomberg Intelligence and lead author of the report said, “The world is poised to see an explosion of growth in the generative AI sector over the next ten years that promises to fundamentally change the way the technology sector operates. The technology is set to become an increasingly essential part of IT spending, ad spending, and cybersecurity as it develops.”

Dominated by AI Infrastructure

The report shows that 85% of the revenue in 2022 was related to computing infrastructure used to train and operate generative AI models. Another 10% is dedicated to running the models, also known as inference. Generative AI software and “Other” services (mostly web services) accounted for just 5% of the total market.

However, that revenue distribution is expected to change over the next decade. In 2027, researchers estimate infrastructure-related revenue to decline from 95% of the market to just 56%. The figure will be about 49% in 2032. Granted, the nominal value of those segments will rise significantly over that period despite the decline in relative revenue share. This forecast is for high growth in all segments, with some playing catch-up.

Filling the gap with faster growth will be generative AI software and other services such as ads, games, IT services, and business services. While the infrastructure segment shows a forecasted CAGR of 33%, the software segment is expected to rise by 69% annually, with “specialized generative AI assistants” rising by 70% and code generation software by 73%. Revenue for those categories in 2022 was estimated at $447 million and $213 million, respectively.

Software and Services Go Big

The net effect is that generative AI training infrastructure will become a $473 billion market while generative AI software with reach $280 billion, and the supporting services will surpass $380 billion. This may seem outlandish to forecast a software segment of a few hundred million dollars will transform into a few hundred billion in a decade. However, the impact of generative AI is so far-reaching it makes everyone rethink old assumptions.

The fact is that many of these new assumptions are plausible, given how many software solution providers are going all-in on generative AI to drive higher productivity and deploy new features. Beyond that, many enterprises are deploying their own custom solutions. Some of the industry growth will be net new, while other segments will displace existing markets such as ad spending, drug discovery, and education.

You may also note that training AI models is far more expensive than running AI inference. This makes sense if you consider investment today. Generative AI is emerging from the research and development phase and transitioning to the commercialization phase of the product maturity model. Investment today is required to build products that can start capturing the flood of cash about to hit the industry. This is one reason why those large language model (LLM) funding rounds are so high, and venture capital firms are eager to invest even at stratospheric valuations.

Synthedia expects the training infrastructure market as the most likely to underperform this forecast after the next three years. There is a lot of innovation focused on reducing model development and training costs, which could lead to more favorable economics in the medium term.

This One Factor Could Kill Bing Chat. Google SGE and Perplexity AI are in a Different League.

Google dominated its early search rivals by delivering higher-quality search results more frequently. However, it was also maniacally focused on speed. That spartan Google search splash page was a sharp contrast to the cluttered portal concept of Yahoo, AltaVista, and the other search giants of the day (and even some of what you see from Bing today).

47% of Technology Leaders Say AI is Top Spending Priority for the Next 12 Months

CNBC surveyed its cross-industry Technology Executive Council and found that 47% identify AI as their top spending priority over the next year. This is more than double the 21% that say cloud computing is the top priority. Overall, nearly two-thirds say their AI investments are accelerating, and it is a bigger piece in a smaller overall pie: a little ov…

Bret. - Great event today. Thank you for putting it together.