NVIDIA Blows Out Revenue Figures as Generative AI Drives Growth

Sovereign AI data centers owned by countries are said to be a growing market

While everyone waits for some resolution of the OpenAI drama, NVIDIA offered a reminder of what company is truly at the center of the generative AI revolution.

NVIDIA announced record revenue of $18.12 billion for its Q3 2024 fiscal reporting period. The key driver was its data center business, which is primarily comprised of GPU sales and combined GPU/CPU systems for generative AI workloads. Data center sales represented the lion’s share of the revenue at $14.51 billion, up from $10.32 billion the previous quarter and $4.28 billion for FYQ1 2024. This reflects 41% quarter-over-quarter growth and is up 278% compared to the same quarter last year.

Generative AI is the largest TAM (total addressable market) expansion of software and hardware we’ve seen in several decades. - Jensen Huang, NVIDIA

NVIDIA CEO Jensen Huang commented:

Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI.

Large language model startups, consumer internet companies and global cloud service providers were the first movers, and the next waves are starting to build. Nations and regional CSPs are investing in AI clouds to serve local demand, enterprise software companies are adding AI copilots and assistants to their platforms, and enterprises are creating custom AI to automate the world’s largest industries.

NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off.

Sovereign AI

Note that Huang mentioned nations and regional cloud service providers (CSPs). In the analyst call this evening, Huang and Colette Kress, NVIDIA’s CFO, mentioned sovereign AI several times. This translates into a government setting up its own AI computing infrastructure. NVIDIA is already generating revenue from this class of customers. According to Huang:

You’re seeing sovereign AI infrastructure. People now recognize that they have to utilize their own data, keep their own data, keep their own culture, process that data, and develop their own AI. You see that in India, and about a year ago in Sweden, you are seeing it in Japan. Last week, a big announcement in France. The number of sovereign AI clouds that are being built is really quite significant. And my guess is that almost every major region, and surely every major country, will have their own AI clouds.

Enterprise Software Companies

Another big area of growth is with enterprise software companies. Huang namechecked SAP, ServiceNow, Adobe, Dropbox, and Getty. While these are not new names, he added that enterprise software represents a $1 trillion market. The trend NVIDIA sees is that they are all adding copilots and LLM-aided knowledge management systems. Some of them will work directly with NVIDIA through its DGX Cloud, an AI Factory offering. Others will use NVIDIA hardware hosted in their preferred cloud hosting provider.

The Path Forward

Cloud service providers and AI startups currently drive the vast majority of the company’s revenue. In fact, NVIDIA is forecasting a rise to $20 billion in Q4 FY2024 revenue despite an expected decline in the gaming segment. Data center sales for GPUs, networking, and software will more than make up for those declines and deliver fourth-quarter growth.

Alongside enterprise software and sovereign AI providers, enterprise customers building their own AI models was also cited as a growth segment. Some of those customers will use their preferred cloud provider, but NVIDIA’s AI Factory offering was also developed to serve this market. Factory customers pay monthly for access to a sandbox and services from the NVIDIA team to help them build and train custom generative AI models. The enterprises can then deploy on NVIDIA AI Enterprise for $4500 per GPU per year.

Huang says the company’s growth follows two key trends: the shift to accelerated computing from general-purpose computing and the rise of generative AI. The industry is building out a lot of capacity as demand rises.

Big cloud providers are still rationing access to NVIDIA GPUs. Access often requires approval by a sales manager and minimum spend commitments over a defined usage window. The AI-workload-optimized Grace Hopper chip is expected to be NVIDIA’s first multi-billion dollar product. NVIDIA enterprise software sales, most of which are for AI solutions, are expected to be a billion-dollar run-rate business by the end of the current fiscal year. NVIDIA is the central node that the entire generative AI industry revolves around.

When there is a transformative industry trend, it is often good to be the company that provides the picks and shovels to prospecters. That ensures you win big no matter which individual company succeeds.

Synthedia is a community-supported publication. Please check out our sponsor, Dabble Lab, an independent research and software development agency that is entirely automated with a mix of in-house AI tools and GitHub Copilot. The founder, Steve Tingiris, is also the author of Exploring GPT-3, the first developer training manual for building applications on GPT-3.

NVIDIA Drives Higher GPU Performance and Sets New Standard in MLPerf Benchmark

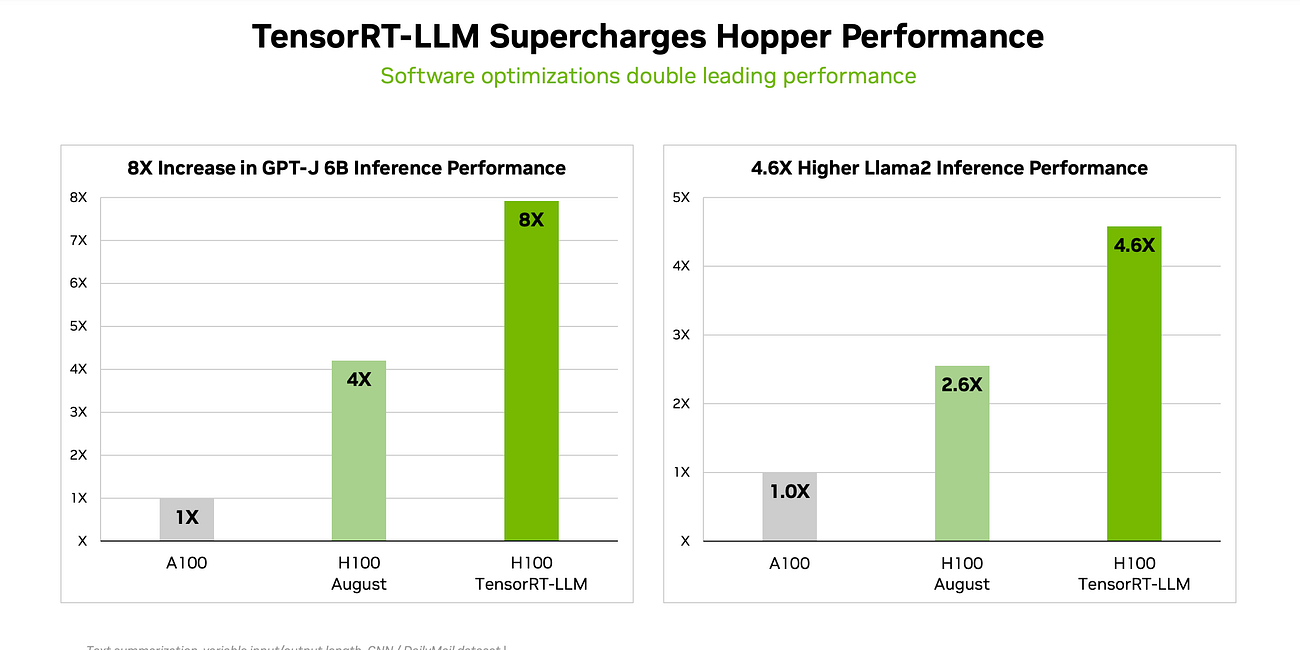

NVIDIA’s H100 GPUs are the gold standard of generative AI workloads, and the company just released new data suggesting the gap with competitors may be getting wider. While the H100s are in short supply and the industry waits for the even higher performance from the forthcoming GH200 GPUs, NVIDIA has announced new software that can double the chip’s perf…

NVIDIA's Monstrous Q2 Revenue Shows Generative AI Spending Ramp-up

“A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI,” said Jensen Huang, founder and CEO of NVIDIA. “During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnership…