NVIDIA's Monstrous Q2 Revenue Shows Generative AI Spending Ramp-up

The company posts a record quarter and is forecasting another

“A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI,” said Jensen Huang, founder and CEO of NVIDIA.

“During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry. The race is on to adopt generative AI.”

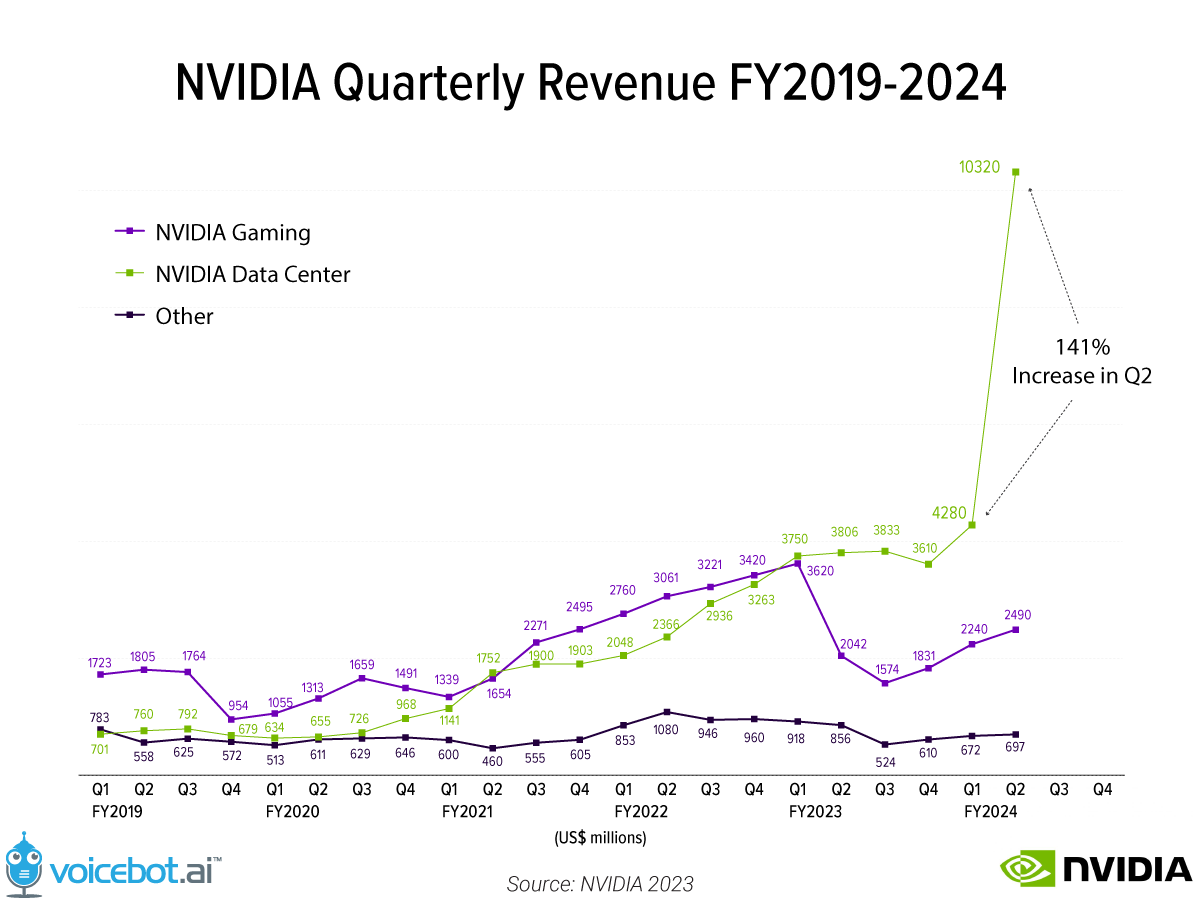

NVIDIA announced quarterly records for total revenue and data center sales. As you can see from the chart and comments above, generative AI is driving explosive revenue for the world’s leading GPU chip maker.

The company posted revenue of $13.51 billion, with $10.32 billion of that coming from the data center division and about $2.5 billion from gaming. Data center revenue is up 141% from Q1 for FY2023, and 171% from Q2 last year.

But wait! There’s more. NVIDIA nearly doubled its previous quarterly sales record by booking Q2 revenue, which represented half its total revenue for each of the past two fiscal years (N.B. NVIDIA’s fiscal year runs from February 1st to January 31st, so Q2 2024 represents the months May, June, July of 2023). The company also forecasts $16 billion in sales for Q3, which would set another record.

There is still high demand for NVIDIA’s A100 and H100 GPUs, which are popular for generative AI workloads. The company will begin shipping the new “GH200 Grace Hopper Super Chip” for complex AI workloads and the new L40S GPU this quarter.

GPU Sales Are Generative AI Leading Indicators

Where’s the revenue? I hear that a lot in LinkedIn comments that question optimistic forecasts for generative AI growth. And I completely understand the skepticism. Many forecasts aren’t very good, and some “researchers” have incentive to pump up market interest. There are so many forecasts related to generative AI that many are surely inflated. However, there is also a lot of money being spent.

It may be unclear how much revenue foundation model providers generate today, but even The Information reported OpenAI is already at a $1 billion revenue run rate. That is likely about 5 months ahead of schedule.

NVIDIA’s explosive growth is interesting because GPU sales of H100s are upstream of generative AI spending on training and inference. You can think of generative AI training as product development cost and inference as operating revenue for foundation model providers. Inference is also a cost, but it will generally be in response to requests by paying customers.

This is also why recent stories around CoreWeave and Modular are so timely. CoreWeave is one of the companies fueling NVIDIA’s growth by purchasing GPUs and then selling processing time to software developers and enterprise users. Modular is selling software that may enable companies to spend less on NVIDIA GPUs.

Bloomberg estimates that generative AI spending will reach $67 billion this year. We might see 50% of that flow to NVIDIA in 2023. As all of those GPUs are employed by foundation model providers and generative AI application developers, the expectation is that their revenue and that of cloud providers will also spike dramatically. However, most of that revenue will not start flowing until 2024. Stay tuned!

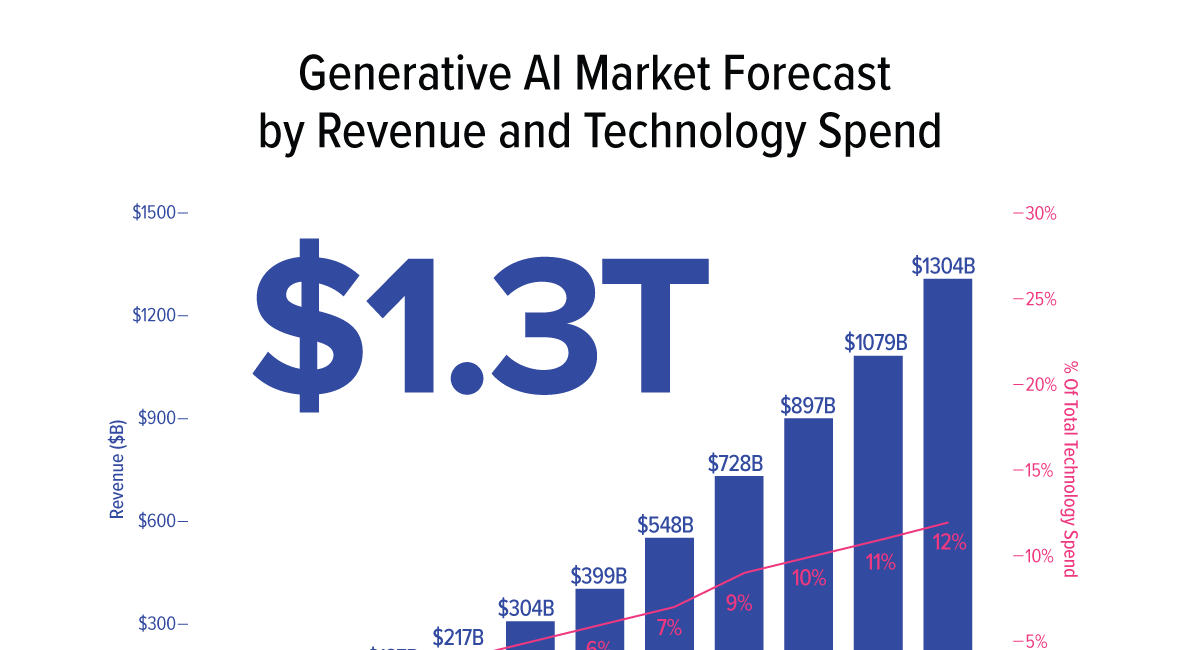

Generative AI to Reach $1.3 Trillion in Annual Revenue - Let's Break That Down

Bloomberg Intelligence forecasts rapid growth for generative AI, rising from about $40 billion in 2022 to $1.3 trillion in 2032. During that period, generative AI will climb from less than 1% of total IT spending to 12%. The growth forecast predicts a 42% compound annual growth rate (CAGR). According to the report:

The Imminent Death of ChatGPT [and generative AI] is Greatly Exaggerated - Look at the Data

“What if Generative AI Turned Out to be a Dud?” “The Rise and Fall of ChatGPT?” These are pretty eye-catching headlines. While Elon Musk is at the vanguard of warning us against the rise of robot overlords, Gary Marcus has carved out a niche as the skeptic of generative AI’s more benign benefits. He brings substantial experience and credentials to the deb…

![The Imminent Death of ChatGPT [and generative AI] is Greatly Exaggerated - Look at the Data](https://substackcdn.com/image/fetch/$s_!_ygQ!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe5a96b72-6627-4806-9d58-598be46f8984_2000x1164.png)