The Imminent Death of ChatGPT [and generative AI] is Greatly Exaggerated - Look at the Data

User adoption is fast and so is revenue generation. What am I missing?

“What if Generative AI Turned Out to be a Dud?”

“The Rise and Fall of ChatGPT?”

These are pretty eye-catching headlines. While Elon Musk is at the vanguard of warning us against the rise of robot overlords, Gary Marcus has carved out a niche as the skeptic of generative AI’s more benign benefits. He brings substantial experience and credentials to the debate, so his positions are worth taking seriously. Marcus’ is also not new to AI skepticism, though he has ramped up his critique in recent months.

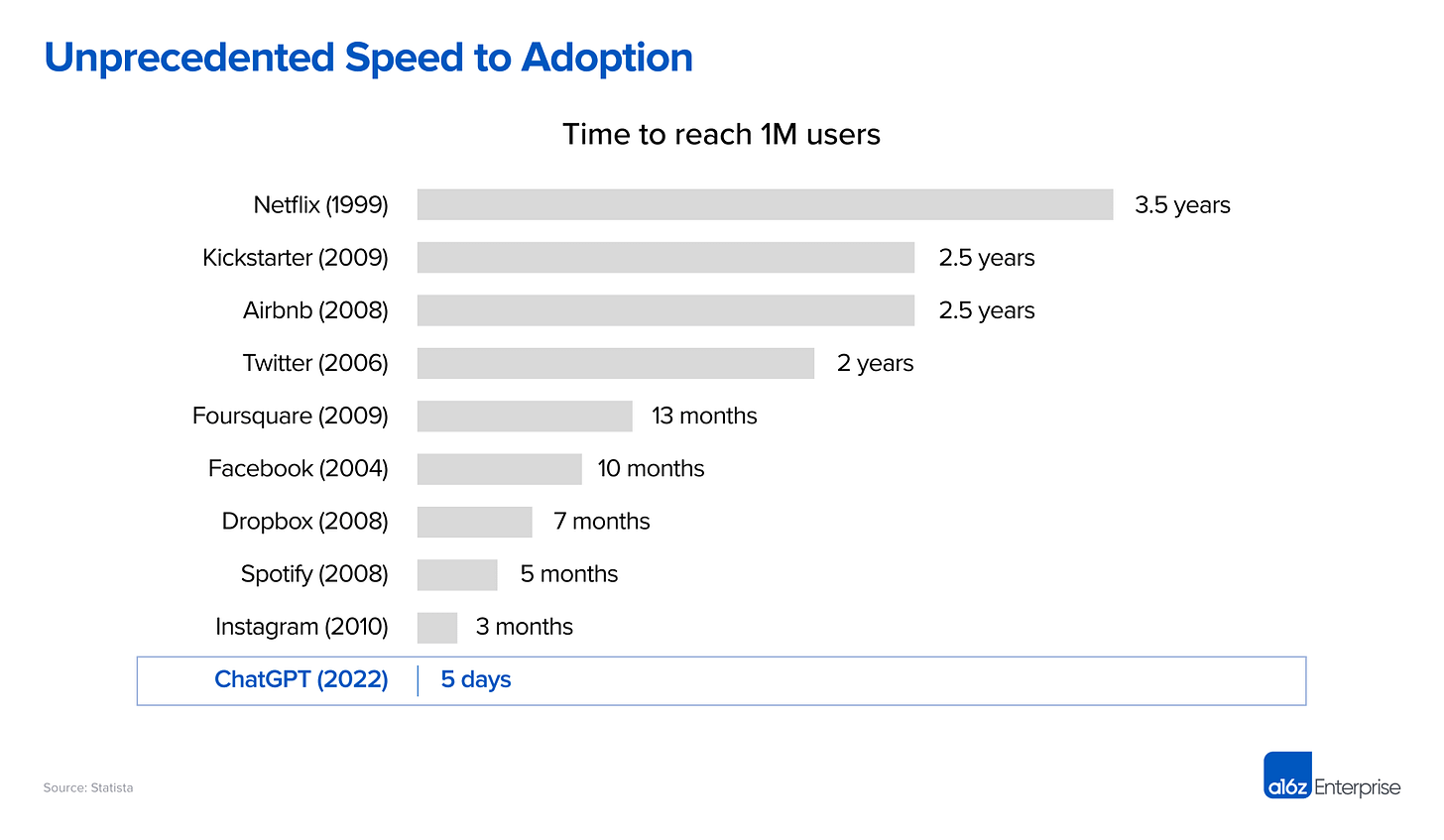

Of course, there is a counter-argument highlighted by the chart above. Adoption (chart above) and revenue (see below) are important indicators that consumers and companies view a product as valuable. Generative AI has both. It is not yet clear whether the initial enthusiasm will result in long-term user retention. However, early indications seem positive.

Hype is not always smoke and mirrors. There are plenty of unfounded claims circulating today in generative AI land, but it is not anywhere near the majority of activity. Most of it appears to be highly productive.

Let’s start with the skeptic movement and then move on to the cheerleader crowd.

The Skeptic

One recent theme has focused on the risk of mediocre AI. In short, the position is that it’s not very good and, at best, will be used by bad actors to cause problems or inadvertently misapplied by the blindly trusting lemmings that inhabit the planet. From Marcus’ newsletter [emphasis from the original]:

You don’t have to be superintelligent to create serious problems. I am not worried, immediately, about “AGI risk” (the risk of superintelligent machines beyond our control), in the near term I am worried about what I will call “MAI risk”—Mediocre AI that is unreliable (a la Bing and GPT-4) but widely deployed—both in terms of the sheer number of people using it, and in terms of the access that the software has to the world. A company called Adept.AI just raised $350 million dollars to do just that, to allow large language models to access, well, pretty much everything (aiming to “supercharge your capabilities on any software tool or API in the world” with LLMs, despite their clear tendencies towards hallucination and unreliability).

This theme of incompetence has been coupled more recently with the idea that the technology is now failing. The introductory evidence for this is a Twitter post by Benedict Evans, some of Gary’s friends, and a few other stories.

“I can’t find any useful application of the technology.”

“Bing didn’t grow market share after adding GPT-4.”

“There are many lawsuits.”

“Get off my lawn!”

Adoption likelihood always depends on what you want and need. I have a lot of respect for Benedict Evans and his market insights. I am surprised that he has found no useful features as that runs counter to my own experience and the many people I encounter in daily work interactions. With that said, I will be interested to see more killer apps and which one wins Evans over.

Beyond Evans, Marcus offers another piece of evidence of generative AI’s pending failure: “Companies are struggling to actually deploy generative AI.” This is a substantive claim that is seemingly backed by data. Let’s take a look at the data Marcus cited from Axios:

Nearly 70% of respondents to the S&P Global survey said they have at least one AI project in production.

But about half of those companies (31% of respondents) are still in pilot or proof-of-concept stage, outnumbering those who have reached enterprise scale with an AI project (28% of total respondents).

Details: Many companies are finding their data isn't organized for the AI revolution — saved in different formats, in disparate datasets, and sometimes still on paper — "forcing a complete rethink of how data is stored, managed and processed," said Nick Patience, senior research analyst at S&P Global Market Intelligence.

Data management (cited by 32%), security (26%) and accessing sufficient computing resources (20%) are the top challenges for respondents to the S&P Global survey.

Around half of the surveyed IT leaders said their organizations aren't ready to implement AI — and suggested it may take 5 years or more to fully build AI into their company workflows.

I could first point out that it is not often 69% of businesses adopt any technology simultaneously. Doesn’t this suggest that something significant is happening in the market? I could also go on and clarify the actual data in the report show that 69% have a capability in production and 28% say they have achieved scale. Granted, this is not exclusive to generative AI as any machine learning capability will suffice. Still, this is a signal of adoption momentum and not friction.

If enterprises looking to adopt a new technology discover their data isn’t ready and they need to change processes and technology architectures that will delay moving into production, that is just normal, everyday, corporate IT problems. This is always the case with any significant new technology.

Does anyone remember when the internet was declared dead? Consider the headline in The New York Times in November 2001, “Dot-com is dot-gone and the dream with it.” Of course, the internet never did die; it only grew. It is hard to see the forest when so many trees obstruct the view. The result is that conventional wisdom is often wrong.

The Cheerleader

On the other side of this debate, we have Andreessen Horowitz, also known as a16z. The high-profile venture capital firm has money at stake, so it has an incentive to paint an attractive picture to generate interest in their portfolio companies. But, they also have some compelling data points, as do McKinsey, IBM, and others that are looking closely at adoption patterns.

a16z recently shared an interesting chart on ChatGPT Plus subscribers. It estimates there are two million users paying $20 per month for the higher-tier service. That is roughly $500 million in annualized revenue.

Although the use cases for this new behavior are still emerging or being created, users—critically—have already shown a willingness to pay. Many of the new generative AI companies have shown tremendous revenue growth in addition to the aforementioned user growth. Subscriber estimates for ChatGPT imply close to $500 million in annualized run-rate revenue from U.S. subscribers alone. ChatGPT aside, companies across a number of industries (including legal, copywriting, image generation, and AI companionship, to name a few) have achieved impressive and rapid revenue scale—up to hundreds of millions of run-rate revenue within their first year. For a few companies who own and train their own models, this revenue growth has even outpaced heavy training costs, in addition to inference costs—that is, the variable costs to serve customers. This thus creates already or soon-to-be self-sustaining companies.

A couple of months ago YipitData estimated that ChatGPT already had 1.5 million ChatGPT Plus subscribers. That would reflect $360 million in annual revenue from the service.

In addition, investment manager Brad Gerstner said offhandedly on a recent All-In Podcast interview that ChatGPT Plus has four million subscribers. That would reflect a billion dollar revenue business. This does not speak to the cost of maintaining ChatGPT, but if earlier estimates of $700,000 per day are to be believed, that adds up to only $255 million. It could be that ChatGPT is already cash-flow positive and maybe wildly so.

Beyond ChatGPT a16z also provided some interesting figures on Midjourney, Stable Diffusion, and Character.AI. All have shown tremendous growth and some of those users are paying members. Midjourney in particular looks like a cash generative machine.

a16z is not alone in its bullishness. Bloomberg Intelligence forecasts generative AI to become a $1.3 trillion annual market by 2032, up from $40 billion last year. McKinsey is even more bullish estimating the total market impact of generative AI is likely to be $6.1 - $7.9 trillion annually. eMarketer forecasts generative AI users will hit 78 million this year in the U.S. alone and surpass 100 million next year. That adoption rate is after than smartphones and tablets.

Market Forces at Play

My Voicebot.ai colleague Eric Schwartz wrote recently about an IBM survey of CEOs that found two-thirds were getting pressure from their boards to adopt generative AI. Nealry as many were feeling similar pressure from investors and nearly half said customers were asking them about their plans.

This is one explanation why so many of the companies cited in the S&P Global Market Intelligence report sponsored by WEKA are adopting AI. It also naturally follows from another finding from the IBM report that productivity gains are the top priority for global CEOs.

So, it seems a little premature to call ChatGPT dead or dying and even more unfounded to make that claim about the generative AI industry. It could be that the market stalls and we see a generative AI winter descend as it has many times through the history of AI. And it is certain that the famed “Hype Cycle” is at play here were people overestimate the impact of technology in the short run and underestimate it the long run to paraphrase Roy Amara.

The hype cycle is neither good nor bad. It is just the normal course of things with the adoption of any new technology. They all go through it to some degree. And there are always the naysayers who claim the descent from the “peak of inflated expectations” into the “trough of disillusionment” proves they were right. For a time, their predictions often look prophetic until the rising adoption hits the less well-known “plateau of productivity” where the most impactful technologies become pervasive.

Generative AI is not magic. It is just another technology. However, the data suggest it is a technology with a lot of adoption and revenue momentum and that generally is a sign staying power.

Amazon CEO Lays Out Generative AI Strategy, Says Everyone in the Company is Using the Tech

Amazon was slower than its rivals to go all-in on generative AI, but it now appears the largest battleship in cloud computing is heading squarely in that direction. Executive realignment and increased investment are clear evidence of this change. Rohit Prasad, the long-time head scientist for Alexa and business leader for the product unit since last yea…